Do 100 Disabled Vets Pay Property Taxes

disabled taxes vetsDepartment of Veterans Affairs. A 100 total and permanent disability rating from being a prisoner of war.

Property Tax Exemptions For Disabled Veterans In California Homebridge Financial Services

Property Tax Exemptions For Disabled Veterans In California Homebridge Financial Services

The modified vehicle must be used at least 80 percent of the time to transport or be driven by a person with an orthopedic.

Do 100 disabled vets pay property taxes. Any qualifying disabled veteran may be granted an exemption of 60000 plus an additional sum from paying property taxes for county municipal and school purposes. There is no rule that exempts vets with a 100 disability from filing a tax return. But as Im sure you already know all disability pay you receive from the VA is not taxable or reportable on any tax return.

Real Estate Tax Exemption Any honorably discharged Pennsylvania resident veteran with a 100 VA disability and wartime service may be exempt from property taxes on their home. Most states exempt disabled vets from paying state income tax but youll also get an exemption on property tax based on your degree of disability and other qualifying factors. Veterans can receive one of the three following exemptions.

A service-connected permanent and total disability or disabilities as determined by the United States Department of Veterans Affairs. A disabled veteran in New Jersey may receive a full property tax exemption on hisher primary residence if the veteran is 100 percent disabled as a result of wartime service. 70 and Over up to 12000 of the assessed value 100 disabled Veterans andor Veterans that are unemployable rated are fully exempt from property taxes in Texas.

The amount for 2019 is 85645. Disabled Veterans in Texas with a 10 to 90 VA disability rating can get a reduction of their homes assessed value from 5000 to 12000 depending on disability percentage. Tennessee Property Tax Exemptions.

Exemptions may apply to school district taxes. Must own and use property as primary residence. The maximum market value on which tax relief is calculated is 175000.

A disabled veteran that is 100 disabled may receive a tax credit of 701 but taxing authorities may increase this up to 4000. Vehicle property taxes are also exempt for disabled veterans and will be extended to their surviving spouse in the event of the veterans death. Disabled Veteran Property Tax Exemption Texas Property taxes in Texas are locally assessed and administered by each county.

Tax Code Section 11131 requires an exemption of the total appraised value of homesteads of Texas veterans who received 100 percent compensation from the US. Veterans with a 100 percent service-connected disability are eligible for a total exemption of property tax on their homes as well as a homestead tax deduction of up to 50000. The additional sum is determined according to an index rate set by United States Secretary of Veterans Affairs.

There are three different property tax exemptions available to Veterans who have served in the United States Armed Forces. Motor Vehicle Sales and Use Tax. Cars vans trucks and other vehicles are subject to motor vehicle sales and use taxMotor vehicles are exempt from tax if they are modified to be used by someone with orthopedic disabilities to help them drive or ride in the vehicle.

Department of Veterans Affairs due to a 100 percent disability rating or determination of individual unemployability by the US. The exemption applies to county city town and village taxes. Never has been either.

Surviving spouses also qualify. Disabled veterans paying taxes in the State of Tennessee may qualify for a state property tax exemption on the first 100000 of hisher primary residence if the veteran is VA-rated 100 disabled or meets the following criteria.

80 Percent Va Disability How To Increase Or Appeal To 100

80 Percent Va Disability How To Increase Or Appeal To 100

States That Offer Free Tuition For Vets Military Benefits

States That Offer Free Tuition For Vets Military Benefits

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Kansas Department Of Revenue Division Of Vehicles Kansas Disabled Veteran Plate

Kansas Department Of Revenue Division Of Vehicles Kansas Disabled Veteran Plate

Disabled Veterans Property Tax Exemptions By State Military Benefits

Disabled Veterans Property Tax Exemptions By State Military Benefits

Ohio Veteran S Benefits Military Benefits

Ohio Veteran S Benefits Military Benefits

North Carolina The Official Army Benefits Website

North Carolina The Official Army Benefits Website

139 Better Budget Categories You Need To Avoid Surprises Budget Categories Budgeting Cash Envelope System Categories

139 Better Budget Categories You Need To Avoid Surprises Budget Categories Budgeting Cash Envelope System Categories

Disabled Veterans Property Tax Exemptions By State Veterans Affairs And Veterans News From Hadit Com Disabled Veterans Disability Property Tax

Disabled Veterans Property Tax Exemptions By State Veterans Affairs And Veterans News From Hadit Com Disabled Veterans Disability Property Tax

Georgia Veteran S Benefits Military Benefits

Georgia Veteran S Benefits Military Benefits

Texas Disabled Vet Property Tax Exemptions Texas Veterans Home Loans

Texas Disabled Vet Property Tax Exemptions Texas Veterans Home Loans

List Of Benefits Due To Service Connected Disability Veterans Resources Disabled Veterans Benefits Va Disability Benefits Military Benefits

List Of Benefits Due To Service Connected Disability Veterans Resources Disabled Veterans Benefits Va Disability Benefits Military Benefits

Free Space A Travel And Other Additional Benefits For 100 Va Rated Vets

Free Space A Travel And Other Additional Benefits For 100 Va Rated Vets

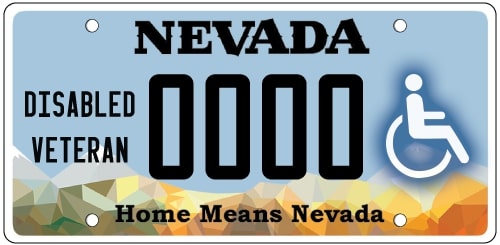

Nevada Military And Veterans Benefits The Official Army Benefits Website

Nevada Military And Veterans Benefits The Official Army Benefits Website

Disabled Vets May Qualify For Higher Ratings Military Com Disabled Veterans Benefits Disability Veterans Benefits

Disabled Vets May Qualify For Higher Ratings Military Com Disabled Veterans Benefits Disability Veterans Benefits

How Much Is 100 Percent Va Disability Disabled Vets

How Much Is 100 Percent Va Disability Disabled Vets

All Vietnam Vets Can File Agent Orange Claims To Get Benefits Agent Orange Vietnam Vets Va Disability

All Vietnam Vets Can File Agent Orange Claims To Get Benefits Agent Orange Vietnam Vets Va Disability

How To Save Big Money On Baby Formula In 2020 Baby Formula Saving Money Big Money

How To Save Big Money On Baby Formula In 2020 Baby Formula Saving Money Big Money