Does Life Insurance Cover Military Death

cover death insurance militaryA life insurance policy is not a savings or investment product and has no cash-in value. If a service member dies in the line of duty the federal government pays a death gratuity.

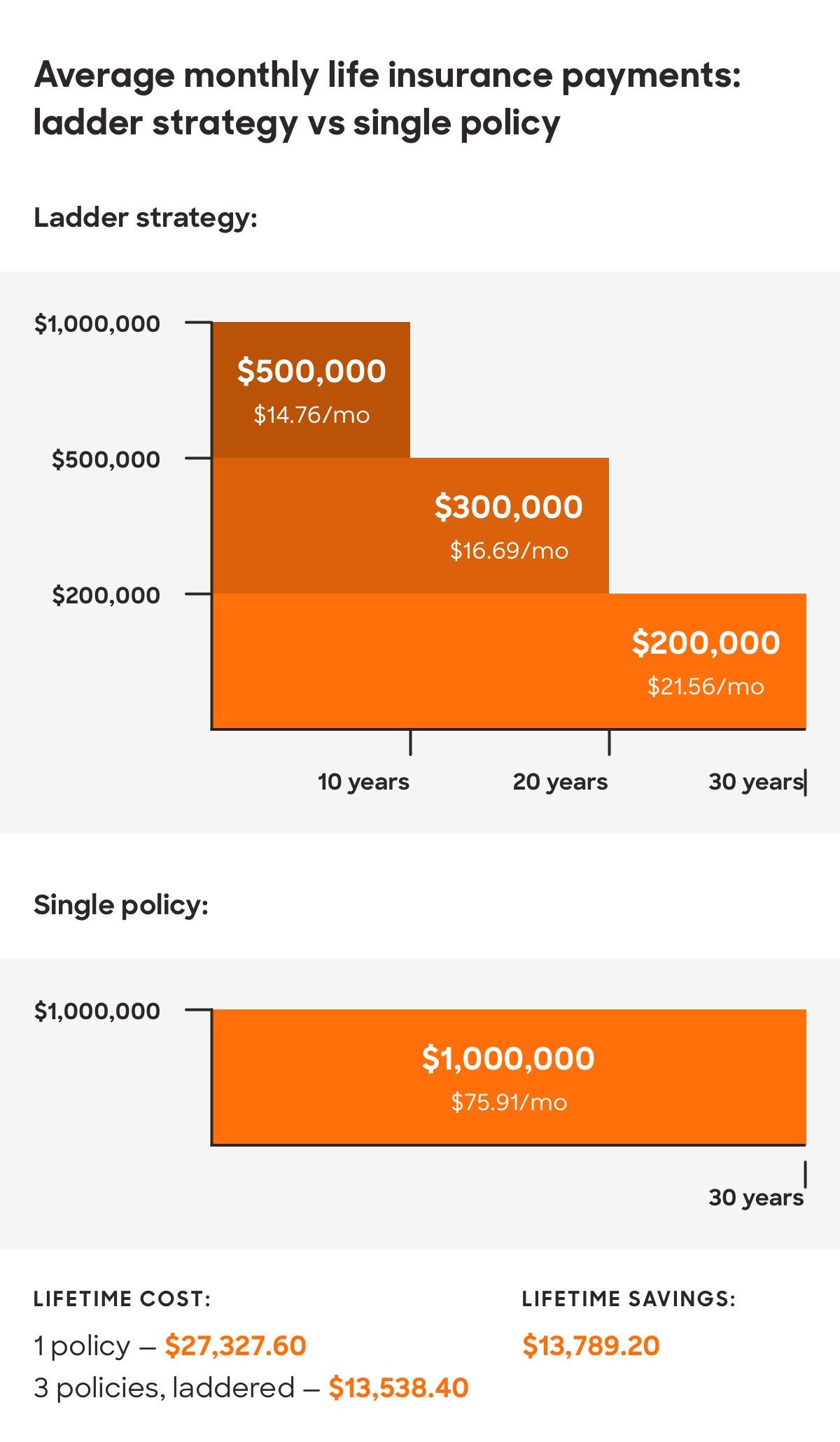

How To Save Money On Life Insurance With The Ladder Strategy

How To Save Money On Life Insurance With The Ladder Strategy

Death gratuity is the first line of defense for military families who lose a service member.

Does life insurance cover military death. Do you need any life insurance in the military. Mortgage life insurance is a policy that upon your death assures your home mortgage is paid off. Members of the military and veterans who qualify for life insurance through Veterans Affairs are generally covered in cases of suicide.

Most life insurance companies have a suicide clause. In life insurance suicide clauses the insurance company will not pay a death benefit for a certain amount of timeusually two yearsafter the policy is purchased. The Servicemembers Group Life Insurance commonly known as SGLI does cover a military death but many private life insurance companies do not.

No other death benefit is paid to beneficiaries. Life insurance companies enforce this clause to prevent the insured person from getting a policy and shortly afterward committing suicide to get a payout for their loved ones. But it could cover you for death at work by natural causes or even accidental death.

Cover may be obtained to financially help your loved ones if you were to die during the length or term of your policy. If it is important to them to have their life covered in the case of death from an act of war they should ensure that the proposed policy meets their needs. Difference between life insurance and accidental death Accidental death insurance will only pay out to your loved ones if you pass away as a result of an accident.

The government does provide an opportunity to convert to Veterans Group Life Insurance VGLI when you leave active duty. Yes they can overlap. While death in service is a really useful benefit when working for a company it is unable to cover every circumstance or deliver in the same way that life insurance does.

All branches of the military recognize that some military-specific life insurance policies may contain exclusion clauses that apply to service members. However a healthy veteran will find VGLI to be a very expensive plan. And if youd like income protection insurance you can still buy our cover through a financial adviser.

A War- or Terrorism-Related Death May Still Be Covered By Life Insurance Not every act that is war-related or terrorism-related is excluded from life insurance coverage. A single lump sum of 100000 to the designated beneficiary or beneficiaries or next of kin. A private insurance policy will cover gaps in military service benefit to provide an overall secure level of financial cover should you die in service.

If someone dies by suicide in the first two years of holding the policy there is no death benefit for beneficiaries. Yes but life insurance premiums rise with age and older people will almost certainly pay more for cover. Its effectively free insurance paid for by the government.

You can apply for life cover online or call us on 0800 068 5549 Monday to Friday 8am to 6pm Saturday 9am to 2pm 1. For example warzone exclusions are common. Can I insure my partner.

It can be tricky for a member of the armed forces to get standard life insurance due to the nature of working in the military. What is life insurance. Military life insurance is designed to accommodate the specific needs and lifestyle of those in the armed forces.

When making a decision regarding life insurance members of the military should be careful to read the small print. For your family to be. Life insurance usually only covers death if you cant provide for your family because of illness or disability you wont be covered.

It is only paid out on death. In short you want to make sure your death wont be excluded as some sort of. Military life insurance policies VGLI and SGLI include coverage for suicide as theres no contestability period or suicide clause.

If you dont already have an adviser you can find one at unbiasedcouk. Does Military Life Insurance Cover Suicidal Death. FSGLI coverage is available to spouses of military members who elect Servicemembers Group Life Insurance SGLI and it includes coverage on children complimentary with the spouse coverage.

Yes term life insurance will cover you for any death if you pass away during the term of your policy. If death happens after the. Today violent conflict can be found all over the globe from formally-declared war to insurrection and terrorist acts.

However one might wonder whether a life insurance policy would cover death resulting from a pandemic like COVID-19. Life insurance may also be known as life cover or life assurance. It is still possible to take out life insurance when you are in your 50s and some firms will accept you without medical or health questions.

A terminal benefit will pay out on diagnosis of a terminal illness. Questionable Life Insurance Situations. You can also buy our life cover through an.

Some life insurance policies provide a terminal benefit although these are not automatically granted.

Pin By Babulle Sharma On Babulle Sharma Mob 9619323912 Life Insurance Agent Comic Books Comic Book Cover

Pin By Babulle Sharma On Babulle Sharma Mob 9619323912 Life Insurance Agent Comic Books Comic Book Cover

Life Insurance For Millenials Why Don T They Buy

Life Insurance For Millenials Why Don T They Buy

Protecting My Family Whole Life Insurance Life Insurance Facts Life Insurance Quotes

Protecting My Family Whole Life Insurance Life Insurance Facts Life Insurance Quotes

Do You Need Life Insurance Life Insurance Facts Life Insurance Sales Life Insurance Quotes

Do You Need Life Insurance Life Insurance Facts Life Insurance Sales Life Insurance Quotes

Our Life Covered For Women By Women Life Cover Life Bad News

Our Life Covered For Women By Women Life Cover Life Bad News

Freedom Fighter A Tribute To Women In The Military Military Heroes Combat Medic Military

Freedom Fighter A Tribute To Women In The Military Military Heroes Combat Medic Military

How When To Buy Life Insurance Is Confusing Whole Life Term Life Are Those The Only 2 Types Is One B Life Insurance Cost Life Insurance Policy Term Life

How When To Buy Life Insurance Is Confusing Whole Life Term Life Are Those The Only 2 Types Is One B Life Insurance Cost Life Insurance Policy Term Life

4 In 10 Wfg Liam Lifeinsurance Life Insurance Quotes Life Insurance Financial Quotes

4 In 10 Wfg Liam Lifeinsurance Life Insurance Quotes Life Insurance Financial Quotes

4 Points What A Life Insurance Policy Gives You Life Insurance Quotes Life Insurance Facts Life Insurance Policy

4 Points What A Life Insurance Policy Gives You Life Insurance Quotes Life Insurance Facts Life Insurance Policy

There Are Numerous Benefits Of Term Life Insurance But Before Having Term Life Insurance You Should Know All The Term Life Term Life Insurance Life Insurance

There Are Numerous Benefits Of Term Life Insurance But Before Having Term Life Insurance You Should Know All The Term Life Term Life Insurance Life Insurance

Why Do U Need A Life Insurance And Are You Buying Insurance With Right Purpose Do Analysis Your Policy And Purpose Of Buying T Life Insurance Life Insurance

Why Do U Need A Life Insurance And Are You Buying Insurance With Right Purpose Do Analysis Your Policy And Purpose Of Buying T Life Insurance Life Insurance

Final Expense Insurance Flyers Google Search Final Expense Insurance Life Insurance For Seniors Final Expense

Final Expense Insurance Flyers Google Search Final Expense Insurance Life Insurance For Seniors Final Expense

Life Insurance Policies For Newlyweds From Bestow Life Insurance Policy Life Insurance Beneficiary Life Insurance Facts

Life Insurance Policies For Newlyweds From Bestow Life Insurance Policy Life Insurance Beneficiary Life Insurance Facts

What Is Voluntary Life Insurance Vs Basic Life Insurance Free Quotes Quickquote

What Is Voluntary Life Insurance Vs Basic Life Insurance Free Quotes Quickquote

Transamerica Life Insurance Review Policies Pricing

Transamerica Life Insurance Review Policies Pricing

Lic S New Annuity Plan Jeevan Akshay Vii Plan No 857 Sum Assured Annuity How To Plan Life Insurance Corporation

Lic S New Annuity Plan Jeevan Akshay Vii Plan No 857 Sum Assured Annuity How To Plan Life Insurance Corporation

Military Life Insurance Is A Low Cost Option For Families The Biggest Misconception Is That S Military Life Insurance American Family Insurance Life Insurance

Military Life Insurance Is A Low Cost Option For Families The Biggest Misconception Is That S Military Life Insurance American Family Insurance Life Insurance